Getting My San Diego Home Insurance To Work

Getting My San Diego Home Insurance To Work

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Policy Program

Significance of Affordable Home Insurance

Safeguarding budget-friendly home insurance policy is important for safeguarding one's residential property and monetary wellness. Home insurance coverage provides protection against different threats such as fire, theft, all-natural catastrophes, and individual obligation. By having a thorough insurance coverage plan in area, homeowners can feel confident that their most considerable financial investment is safeguarded in case of unanticipated conditions.

Budget-friendly home insurance coverage not just supplies monetary protection however likewise supplies satisfaction (San Diego Home Insurance). Despite climbing home worths and construction prices, having a cost-effective insurance coverage policy makes certain that homeowners can conveniently rebuild or repair their homes without facing substantial financial problems

Furthermore, economical home insurance policy can also cover individual items within the home, using compensation for items harmed or taken. This insurance coverage prolongs beyond the physical structure of your home, securing the contents that make a residence a home.

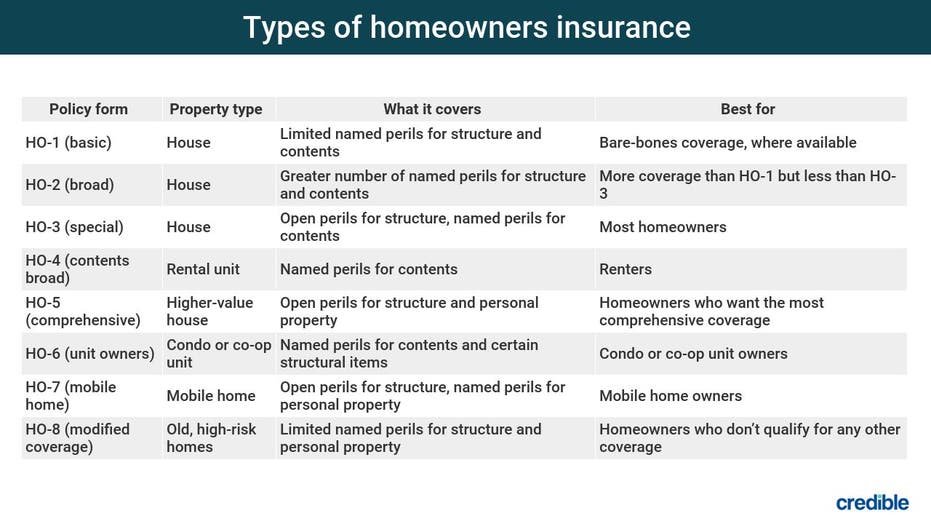

Protection Options and Boundaries

When it involves insurance coverage restrictions, it's important to understand the optimum amount your policy will certainly pay for every type of protection. These limits can find out here differ relying on the plan and insurance firm, so it's essential to review them carefully to ensure you have appropriate defense for your home and properties. By recognizing the protection choices and restrictions of your home insurance coverage, you can make enlightened choices to safeguard your home and loved ones successfully.

Factors Influencing Insurance Policy Costs

A number of variables considerably influence the costs of home insurance plans. The location of your home plays a crucial role in determining the insurance premium.

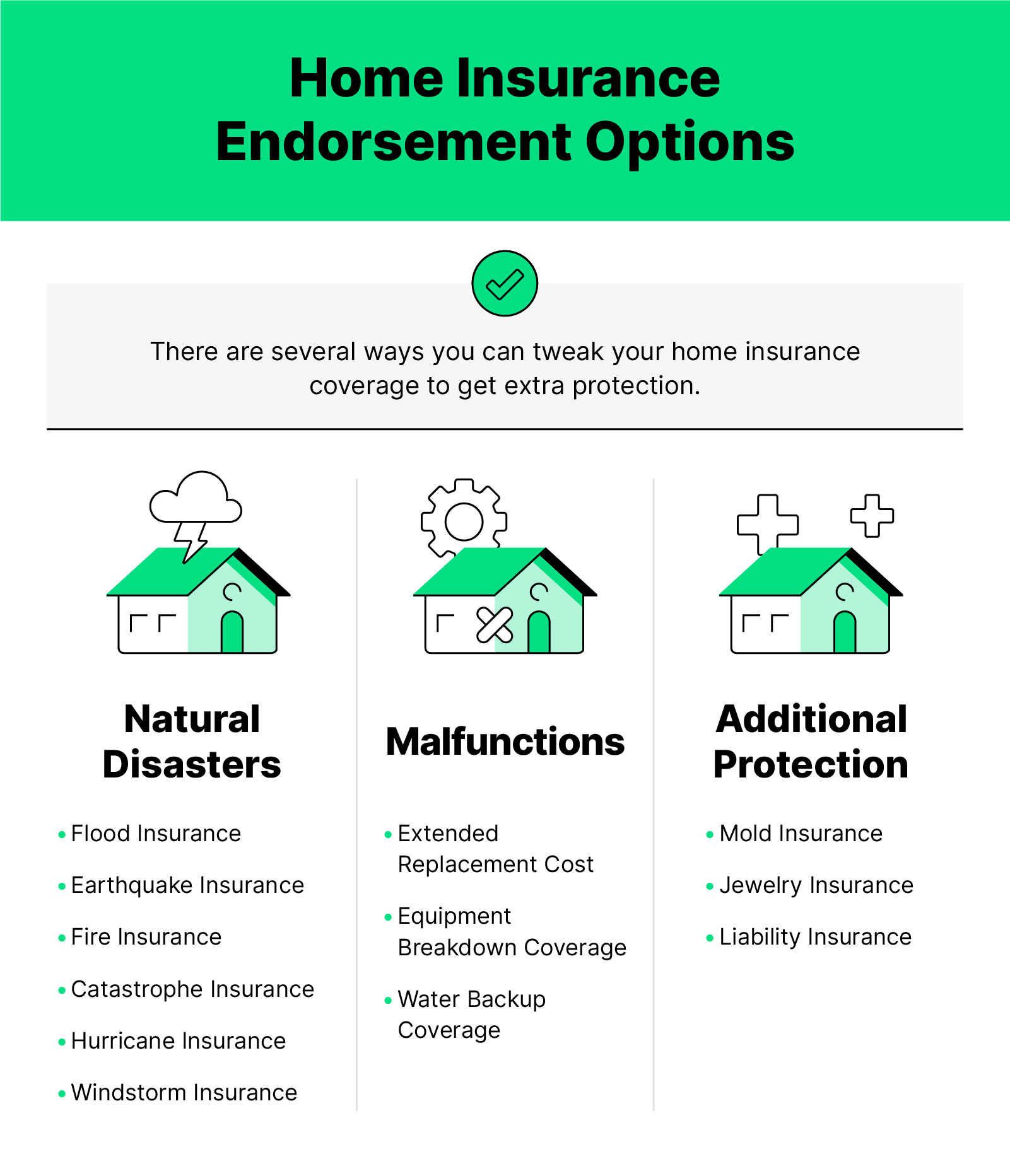

Additionally, the type of insurance coverage you choose straight influences the cost of your insurance plan. Opting for extra coverage alternatives such as flooding insurance or earthquake protection will certainly boost your premium.

Furthermore, your credit rating, claims background, and the insurer you pick can all affect the rate of your home insurance coverage. By thinking about these elements, you can make informed choices to help handle your insurance policy costs effectively.

Comparing Service Providers and quotes

In addition to contrasting quotes, it is critical to review the reputation and economic stability of the insurance service providers. Search for customer testimonials, scores from independent firms, and any background of complaints or regulatory activities. A trustworthy insurance copyright ought to have an excellent track document of quickly processing insurance claims and offering superb client service.

Furthermore, consider the details insurance coverage functions provided by each copyright. Some insurance firms might offer added benefits such as identification theft security, equipment breakdown coverage, or coverage for high-value items. By thoroughly comparing providers and quotes, you can make a notified decision and choose the home insurance strategy that best fulfills your needs.

Tips for Saving on Home Insurance Coverage

After thoroughly comparing providers and quotes to find the most suitable coverage for your demands and budget, it is prudent to explore efficient methods for saving on home insurance coverage. Numerous insurance business supply discounts if you acquire numerous policies from them, such as incorporating your home and car insurance policy. Consistently assessing and upgrading your policy to reflect any kind of adjustments in your home or situations can guarantee you are not paying additional info for protection you no longer requirement, helping you conserve money on your home insurance coverage premiums.

Conclusion

Finally, safeguarding your home and liked ones with budget friendly home insurance policy is important. Comprehending coverage limits, aspects, and alternatives influencing insurance policy costs can help you make notified choices. By contrasting quotes and companies, you can locate the most effective plan that fits your requirements and budget. Carrying out suggestions for saving on home insurance coverage can additionally assist you secure the required security for your home without breaking the bank.

By unraveling the intricacies of home insurance coverage strategies and exploring functional strategies for protecting budget friendly protection, you can make sure that your home and liked ones are well-protected.

Home insurance policy plans commonly provide numerous insurance coverage alternatives to safeguard your home and valuables - San Diego Home Insurance. By comprehending the coverage choices and restrictions of your home insurance plan, you can make informed choices to secure your home and loved ones successfully

Consistently evaluating and updating your plan to show any modifications in your home or situations can ensure you are not paying for coverage you no longer demand, assisting you save cash on your home insurance costs.

In conclusion, safeguarding your home and liked ones with official website affordable home insurance coverage is crucial.

Report this page